Xiangshuo earned more than 2 shares in the third quarter, and its EPS in the first three quarters reached 52.62 yuan

IC design manufacturer Xiangshuo held a press conference on the 11th to announce its third quarter financial report for 2025. Mainly benefiting from the improvement in foundry (ASIC) business momentum and recognition of Techpoint's revenue, third-quarter EPS reached NT$21.21.

Xiangshuo’s consolidated revenue in the third quarter was 3.992 billion yuan, an increase of 18% from the second quarter and an increase of 88% from the same period in 2024. Net profit after tax in the third quarter was 1.582 billion yuan, an increase of 41% from the second quarter and an increase of 62% from the same period in 2024. The gross profit margin was 51% and EPS was 21.21 yuan. Cumulatively, consolidated revenue in the first three quarters of 2025 was 9.894 billion yuan, an increase of 60% over the same period in 2024, net profit after tax was 3.926 billion yuan, an increase of 40% over the same period in 2024, and EPS was 52.62 yuan.

Xiangshuo said that the company will continue to focus on diversified growth momentum, including the continued increase in USB4 volume, the start of PCIe Gen4 shipments, stable cooperation with major customers, and automotive revenue to drive growth. It is expected that the operating performance in 2026 will be better than that in 2025.

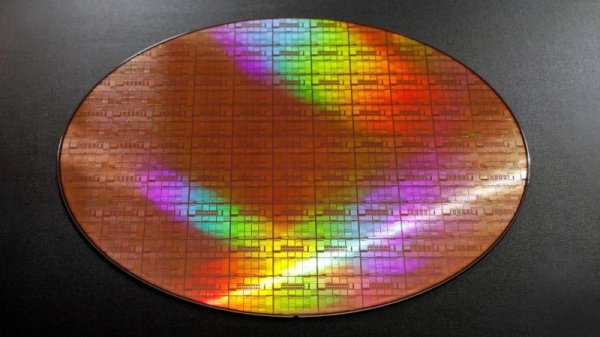

Xiangshuo pointed out that in terms of ASIC/OEM services, Xiangshuo has shipped more than 100 million self-made ASIC chips since 2016 and has accumulated mature experience in high-speed SerDes IP and chipset technology products. Its compatibility and stability have been recognized by customers and the market. At the same time, Xiangshuo also continues to deepen project cooperation with other important customers. Currently, the design phase is progressing smoothly, laying a good foundation for medium- and long-term operational stability.

In terms of product progress, Xiangshuo maintains its leadership in high-speed I/O technology. The entire series of Xiangshuo USB4 products have obtained Thunderbolt 4 certification, symbolizing another upgrade of Xiangshuo's product layout in the Thunderbolt ecosystem, providing complete solutions for edge AI computing, professional users, and high-performance storage markets. Driven by the demand for high-speed applications such as gaming, AI edge, and data servers, and the development of high-end computers towards product differentiation with high performance and multiple port numbers, Xiangshuo host products currently have good penetration in the high-end market. As the host becomes more popular, it will also drive the simultaneous growth of the device (Device), making high-speed I/O gradually become a standard feature of high-end PCs.

As for PCIe, Xiangshuo is the only company in Taiwan and one of the few companies in Asia that has its own R&D technology and mass production capabilities for PCIe Packet Switch. AI demand has spread to edge-end or mid-to-low-end servers, and these applications require PCIe Packet switch. The market for Xiangshuo's PCIe Gen 4 Packet Switch includes new customers with high lane counts and upgrades for existing customers. Its application areas include servers, edge computing, NAS, survey and IPC, etc.

In the automotive market segment, Techpoint will contribute full-year revenue starting from 2026. New ISP products will be launched soon, and there will be a test chip in 2026. In the future, Techpoint will continue to use Xiangshuo SerDes technology to add new product lines and maximize integration benefits. Currently, the integration of Techpoint is proceeding as planned and is expected to demonstrate better operational synergies and growth contributions. Looking forward, new products (PCIe Gen5, USB V2) are expected to tape out in 2026, and ASP is expected to grow. The company's future growth momentum comes from many sources, and it has invested in the research and development of PCIe Gen6/7. In addition, the automotive market is stable and it continues to optimize its product portfolio.