TSMC estimates fourth-quarter revenue to drop 1%, raises capital expenditures by US$40 billion to US$42 billion

In the third quarter, TSMC posted a record single-quarter consolidated revenue of NT$989.92 billion, net profit of NT$452.30 billion, and diluted EPS of NT$17.44 (US$2.92 per American depositary receipt). Compared with the same period in 2024, third-quarter revenue increased by 30.3%, and net profit and diluted EPS increased by 39.1% and 39.0% respectively. Compared with the second quarter of 2025, third-quarter results showed revenue growth of 6.0% and net income growth of 13.6%.

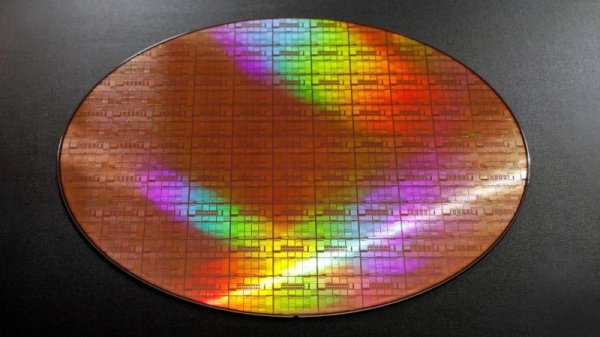

In US dollars, revenue in the third quarter was US$33.10 billion, an annual increase of 40.8% and an increase of 10.1% from the previous quarter. The gross profit margin for this quarter was 59.5%, the operating profit margin was 50.6%, and the net profit margin was 45.7%. In the third quarter, 3-nanometer wafer shipments accounted for 23% of total wafer revenue, 5-nanometer accounted for 37%, and 7-nanometer accounted for 14%. Advanced technology (defined as 7nm and above) accounts for 74% of total wafer revenue.

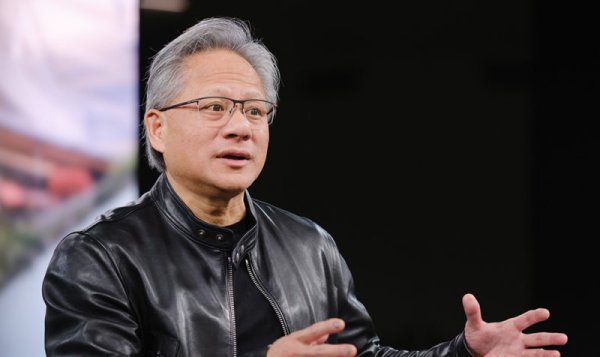

Chief Financial Officer Huang Renzhao stated that the actual gross profit margin in the third quarter was even 200 basis points higher than the high point of the financial forecast range provided three months ago. This is mainly because the actual average exchange rate in the third quarter was NT$29.91 per U.S. dollar, which was better than the forecast assumption of NT$29 per U.S. dollar. At the same time, the company also achieved better-than-expected results in cost improvement.

Looking forward to the fourth quarter of 2025, revenue is expected to be between US$32.2 billion and US$33.4 billion. If calculated based on the mid-point exchange rate assumption (1 U.S. dollar to NT$30.6), revenue fell 1% from the third quarter, but the annual growth rate was 22%. Gross profit margin ranges from 59% to 61%. At the midpoint, gross margin is expected to be 60%, an increase of 50 basis points from the third quarter. This growth was primarily driven by more favorable foreign exchange rates, but was partially offset by continued dilution from overseas fabs. The operating profit margin is expected to be between 49% and 51%.

As structural AI-related demand continues to be very strong, TSMC stated that it will continue to invest to support customer growth. As a result, the company has revised upward the range of its full-year capital expenditures in 2025, adjusting it to between US$40 billion and US$42 billion, higher than its previous forecast of US$38 billion to US$42 billion. The allocation structure of the capital budget is about 70% advanced process, 10%~20% professional technology, 10%~20% advanced packaging, testing, mask production and others.

Regarding the impact of overseas expansion on gross profit margin, the company provided the latest dilution expectations. Huang Renzhao said that although the cost of overseas wafer fabs is still high, thanks to the expansion of the company's overall scale, it is expected that the gross profit margin dilution caused by the commissioning of overseas wafer fabs will be close to 2% in the second half of 2025. The full-year gross profit margin dilution forecast for 2025 has been revised from the original 2% to 3% to 1% to 2%. Looking into the next few years, the company predicts that the gross profit margin dilution brought by overseas wafer fabs will remain at 2% to 3% in the early stage, and expand to 3% to 4% in the later stage.

TSMC stated that it will use Arizona to grow its scale and continue its efforts to improve its operational optimization cost structure. The company will leverage its fundamental competitive advantages of its manufacturing technology leadership and large-scale production base to become the most efficient and cost-effective manufacturer in every region in which it operates. The company will also continue to work closely with customers and suppliers to manage the impact of overseas expansion.