It will be very desirable if Taiwan has higher taxes than those in the country! Recovery of China Investment News: The key is still in the tax rate of the US Terms 232

Recovery of China Investment Credit will hold its investment outlook for the second half of the year today. The head of the domestic equity department, Jun Hongyu, said that Taiwan's tax award is imminent, assuming that more than 32% will be desirable, because it will cause a large number of industry outflows when it is higher than that of neighboring countries, but it actually affects Taiwan's more tax rates of "US 232", which depends on whether the end customers are willing to accept the transfer.

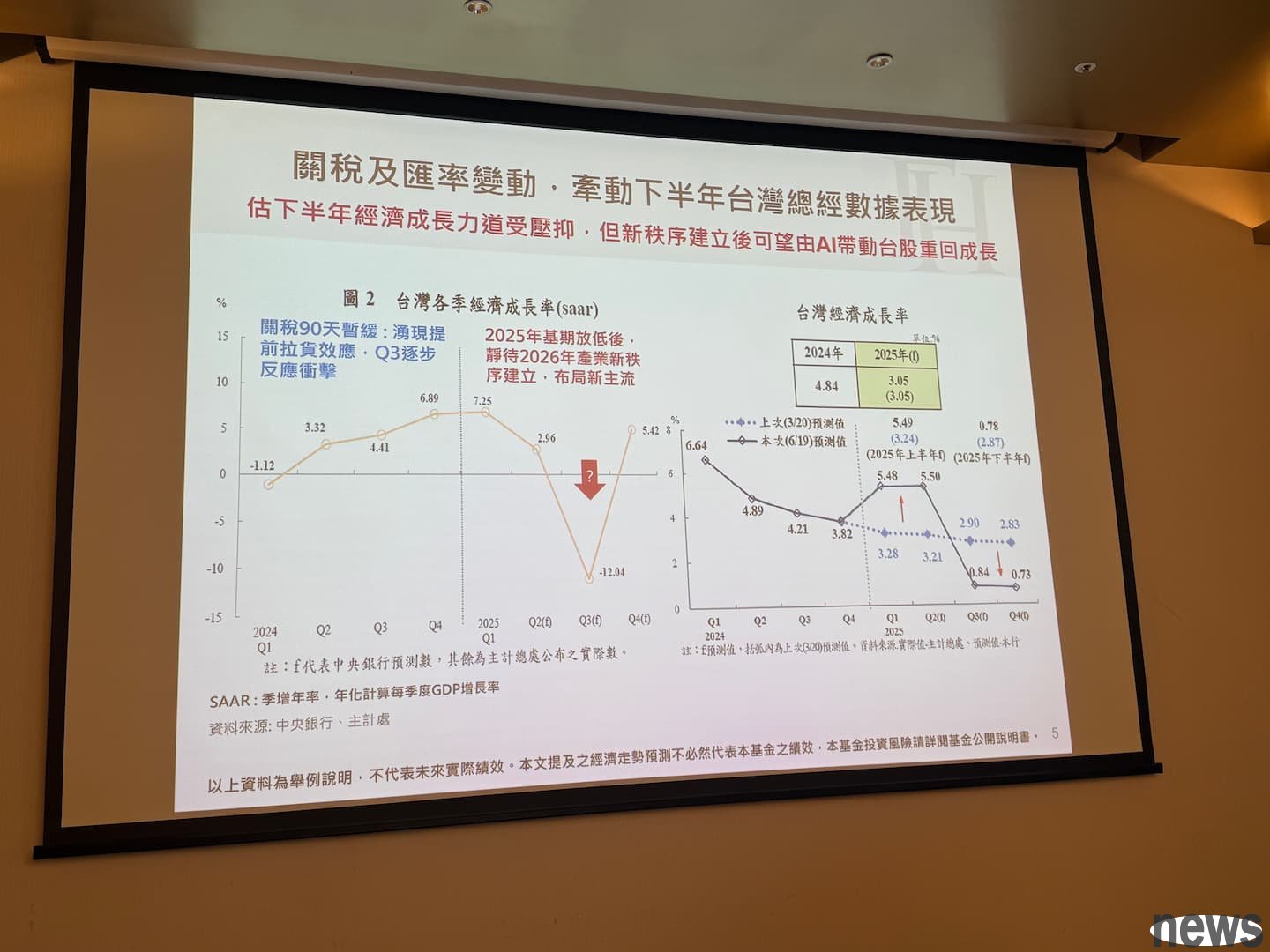

Recovery Investment Credit stated that the Taiwan Stock Exchange showed a low before and high trend in the second half of the year due to tax and exchange rate issues, and the market was estimated to be 21,000-25,000 points. After the establishment of a new trade order and the deterioration of uncertain factors, AI will lead Taiwan stocks to return to the road of growth and creation of growth. Supply chains such as semiconductors and ASICs are the main themes of the long-term layout of the industry. New Taiwan Coins need to benefit from appreciation, and high interest rates and low volatility are the highlights of the industry.

Jun Hongyu said that in the first half of the year, benefiting from the booming export of AI servers, and the related industry revenue was high, but the uncertainty of taxes has slowed down the investment in the second half of the year, suppressing the growth dynamics of Taiwan's overall economic economy in the third quarter. As the base period is lowered, a new industry order will be established. The hot AI demand has led to the growth rate of corporate profits and the growth rate of major economic markets will be positive next year, supporting the performance of the Taiwan stock market in the second half of the year.

The tax award for Taiwan is about to be awarded. Jun Hongyu said that it would be desirable to assume that it would be more than 32%, because currently 25% in Japan and South Korea, and then 20% in Vietnam, and as for Southeast Asia, it would range from 25% to 32%. Assuming that Taiwan is higher than that of neighboring countries, it would cause a large number of industries to move outward, which is not that beneficial to Taiwan's entire capital market, but currently it is estimated that Taiwan has the highest chance of 20% to 25%.

Jun Hongyu pointed out that Taiwan should pay attention to the tax rate of the "US 232" because this is related to semiconductors and AI servers. It is relatively large to hit Taiwan. At the time, it can only look at whether the final customers are willing to transfer, or whether Taiwanese businessmen have plans to go to the US factory, so as to adjust the planning of production capacity and reduce related attacks.

In terms of industry layout, Wan Hongyu pointed out that the market uncertainty factors have been eliminated, and AI will become the main theme of growing stocks. Cloud service suppliers (CSPs) capital expenditures continue to grow. It is estimated that ASICs are still in the long-term of gold growth. Then robots are the killer applications of AI. It is estimated that humanoid robots will show an exponential growth in the future. It is recommended that investment opportunities be found from speed reduction machines and transmission components industries.

Non-electricity industry layout, Mu Hongyu believes that after the financial industry is brought to IFRS17, the stock sector will be cancelled, and the impact of stock price shocks will be affected. In the future, the financial stock layout will tend to choose high interest rates and low fluctuations. Due to tax policies, the US dollar weakens and the purchase power of New Taiwan Coin has increased. You can choose domestic demand industries that own assets, such as aviation, travel, food, catering, retail, telecommunications and asset stocks.

Extended reading: Taiwan tax levy award is about to begin! Covering 80% of Taiwan's US products "US Terms 232" will be even bigger Trump's second wave of tax list is complete and eight countries are coming! Brazil increased from 10% to 50% reason exposed Taiwan has not yet made the list! US President Trump announces new round of Philippine 20% tax list