Automotive chip market recovers, NXP reports good news for Q3, rises 1.7% after hours

NXP Semiconductors released its latest financial report on October 27. Both its last quarter performance and financial forecast were better than market expectations. This was mainly due to the recovery of the automotive chip market, which encouraged NXP's stock price to continue to rise after the market closed on the 27th.

Reuters reported that NXP’s financial report released on the 27th showed that in the third quarter of 2025 (as of September 28, 2025), revenue decreased by 2% year-on-year to US$3.17 billion, but slightly lower than market expectations of US$3.16 billion; adjusted earnings per share were US$3.11, in line with market expectations. The main driving force comes from the high tariffs imposed by the United States on automobiles and components, which has prompted car manufacturers to expand their presence in the United States, boosted demand for automotive chips, and boosted NXP's performance.

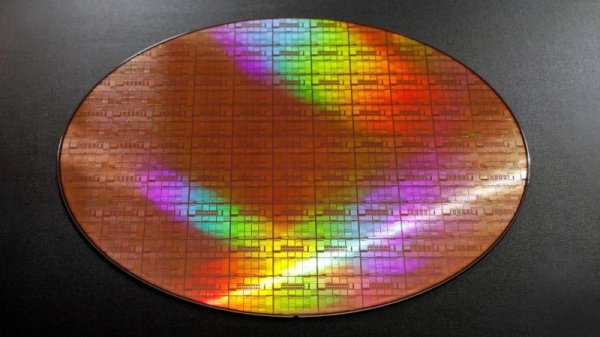

(Source: NXP Semiconductors)

Looking at the performance of the main business departments, in the third quarter, the revenue of the automotive business group increased by 0% annually and 6% quarterly; the revenue of the industrial Internet of Things business group increased by 3% annually and 6% quarterly; the revenue of the mobile device business group increased by 6% annually and 30% quarterly.

In terms of financial forecasts, NXP is optimistic that fourth-quarter revenue will reach US$3.2 billion to US$3.4 billion, with the median higher than analysts’ average forecast of US$3.24 billion.

NXP has been actively engaged in acquisitions recently. Last week, it acquired Aviva Links, an in-vehicle network company, for US$243 million in cash. In June this year, NXP completed the acquisition of Austrian automotive software developer TTTech Auto for US$625 million in cash to strengthen its automotive smart software layout.

Yahoo Finance quotes show that in normal trading on October 27, NXP’s stock price rose 1.10% to close at US$221.56, and then rose 1.76% to US$225.45.