The semiconductor shock against Taiwan will be revealed, and the US Terms 232 investigation will be understood at one time

The United States launched a Section 232 investigation in April and is expected to release a survey report in the near future. This provision that gives the United States the general power to impose trade restrictions on imported goods on national security has attracted global attention. In particular, US President Donald Trump is using this tool to investigate semiconductors and other products, and is regarded as the main battlefield for Taiwan-US tax trade debate.

What is the term 232?

The so-called 232 clause, which is stipulated in Section 232 of the Trade Expansion Act of 1962, authorizes the US President to submit a survey on whether specific imported products affect national safety. The Secretary of Commerce must submit a report to the President within 270 days after the procedure is initiated. Once it is recognized as a national security threat, the U.S. president can directly adopt trade restrictions such as raising taxes. U.S. Commerce Secretary Howard Lutnick announced on July 27 that he would publicly review the results of the investigation within two weeks.

US President Donald Trump once said that tax responsibilities are the most beautiful words in the dictionary, and the terms 232 clearly provide legal backing for him to withdraw tax ties. As early as 2018, Trump issued 232 clauses to charge 25% and 10% taxes on steel and aluminum courses, respectively. After returning to Baigong, he re-used the same trick. Shortly after taking office, he charged 25% taxes on these two metals. In June, he signed a document to double the tax rate to 50% in order to further protect American related industries.

232 style sharp bladeAt that time, Trump said that based on the latest information provided by Lutnik, he decided that it was necessary to raise the tariffs on steel, "so that the import of these products will not threaten the national security structure." The imported cars and specific parts that were launched under the State Security Bureau of Article 232 in 2018 revealed the main purpose of promoting the return of manufacturing industry to the United States under the State Security Bureau. When Trump announced in April this year that he would charge 25% taxes for all cars made in foreign countries and imported into the United States, he shouted bluntly, "If it is made in the United States, there will be no taxes at all."

Simply put, Term 232 is a weapon for Trump to "make the United States bigger again", providing legitimacy for his tax collection, aiming to strengthen the United States' ability to produce important products and ensure that it will not be "bottled" by foreign countries during war or in short supply. In addition to previous steel and aluminum, as well as automobiles and parts, the 232 surveys currently underway also include seven major product areas including semiconductors and their manufacturing equipment, key mining processing and downstream products, copper and copper products, trucks and their parts, commercial aircraft and spray engines and parts, wood and wood products, medicines and their raw materials.

232 Survey AreasIn addition, in the latest operation announced in July, the U.S. Department of Commerce also conducted a national security survey on imported unmanned machines and related components, as well as polysilicons for solar batteries and semiconductors made of polysilicons in accordance with clause 232. It is generally believed that the Trump administration has extended the investigation to unmanned machines and polycrystalline silicon this time, highlighting the United States' high concern for China's supply chain, because China currently controls most of the commercial unmanned machines in the United States, and the key material polycrystalline silicon, made by solar batteries and chips, has led the global supply market by China.

As an important global export economy and manufacturing center, Taiwan has increased its influence on Taiwan as its export proportion to the United States is increasing day by day. According to the Ministry of Economic Affairs, nearly 80% of Taiwan's exports to the United States in 2024 are subject to 232 tax ties, including semiconductors, mobile phones, PCBs (printed circuit boards), panels, machinery, tool machines, industrial computers, bicycles, home appliances, etc., which may be affected. Among them, high-tech exports are the focus of observation, especially the 232-terminal tax investigation to be announced in August, which may have a deeper impact on Taiwan.

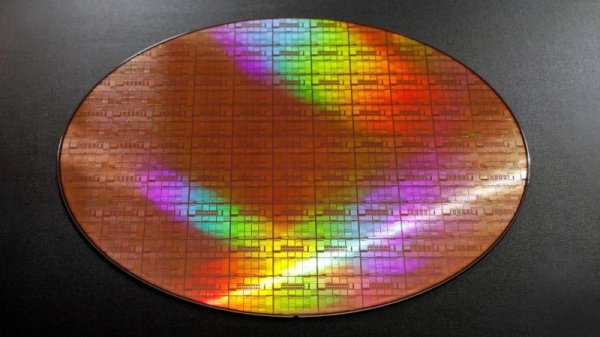

232 Nuclear Level SurveyThis is because although the United States strives to increase domestic semiconductor production through the 2022 Chips and Science Act (CHIPS and Science Act) based on national security considerations, it still relies on imported chips and materials. According to the Council on Foreign Relations of the US Smart Bank, the United States has a highly concentrated import source in this area, and nearly half of the 5 countries alone provide nearly 80% of the relevant imported products of the conductor. Among them, China ranks first, accounting for more than one-quarter of the import volume, and occupies a leading position in the global assembly, testing and packaging (ATP) field, with nearly one-third of ATP factories, including facilities of many American companies. Taiwan accounts for nearly one-fifth of the United States' imports, supplying crystalline and finished chips.

The U.S. Department of Commerce officially launched 232 surveys on semiconductors and related products on April 1, covering an unprecedented range of integrated circuits, computer components, cords, various types of wafers from mature processes to advanced processes, semiconductor manufacturing equipment, and "derivative products" containing semiconductors. This "derivative product" means not only the threat of the crystal foundry, but may also affect Taiwan's export bulk such as servers, display cards, and online exchangers, affecting the competition of the institute and the semiconductor industry that will hinder Taiwan's semiconductor industry.

The US levy of 20% of the taxes on Taiwan's courses will be implemented on August 7th. However, compared to 20% of the number, what really needs to be observed is Trump's semiconductor and electronic component taxes under Term 232, especially information communication (ICT) industries such as artificial intelligence (AI) servers. This survey report on Term 232 is the nuclear tool for Trump's tax control..

(Source: International Trade Department of Economic Affairs)

Extended reading: Taiwan's tax 20% has caused three major shocks! The Ministry of Economic Affairs revealed that these four industries are "maligned" Legal person: Taiwan 20% Tax rate is a tax-related outpost, and the focus is on obtaining the most favorable country terms Trump has finalized taxes on the taxes, and read the article on content and influence Trump's 20% tax on Taiwan classes is higher than in Japan and South Korea! How to get rid of the conditions for judging? 232 Terms of Development