Intel may be able to sell 49% of the GRF, but it is unlikely to split and list.

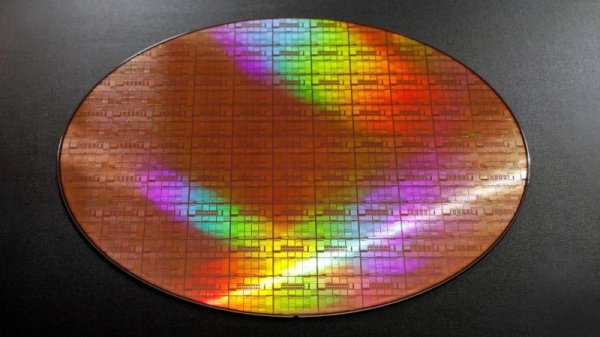

Intel's chief financial officer David Zinsner confirmed that Intel can sell up to 49% of its shares in its business to external investors and will not violate the agreement with the US government. With limited ownership restrictions, control of some wafer manufacturers and limited interested investors, Intel is unlikely to fully open an IPO or spin off its business.

Sinzna said at the 2025 Global TMT Conference that Intel must control at least 51% of the wafer factory business within five years, otherwise it will be subject to decree terms. Intel's government financing structure includes stock-related equity licensing. If Intel sells more than 50% of its business, it will affect its equity structure. Therefore, Intel wants to maintain a 51% controlling stake in order to avoid sparse investors.

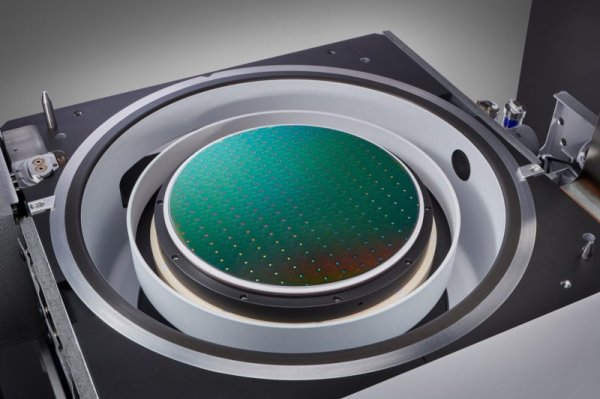

Intel and the US government's agreement, Intel must maintain GM factory holdings for five years, greatly reducing the possibility of a full spin-off. The US government invested about 10% of Intel's shares with US$8.9 billion, and held the option. If the CNC manufacturer's holdings are less than 51%, it can increase its holdings by another 5%, indicating that the US government's control over key industries. Intel currently operates all semiconductor lines in the United States, Irish and Israel, but does not fully own all wafer factories.

Intel launches Semiconductor Co-Investment Program (SCIP) in 2022 to attract investors and does not violate the CHIPS Act to collect $26 billion. Although Intel lost 100% control of the advanced wafer factory, the wafer factory ownership is jointly owned by Intel and other investors, despite this, Intel retains the wafer factory's rights and revenue merger reports. This partial ownership may affect Intel's subsequent IPO, as investors will consider that Intel does not own all cash flow and may reduce valuation.

Overall, it is unlikely that Intel's foundry business will be fully split or IPO within a few years, because the U.S. government's ownership requirements and market interest can raise limited funds.

Intel could sell up to 49% of its foundry business to external investors, but a full IPO or spin-off is unlikely Extended reading: Intel announces a number of personnel outrage, including a high-level vocational officer who has been a co-executive officer at a time Qualcomm executive: Intel chip manufacturing "is not an option yet" Intel claims government stakes to eliminate subsidy uncertainties and will "rely rely on NTD" Intel claims US government to invest in a stake in order to prevent the abandonment of the crystalline foundry business Intel engineers said that the delivery of the Cylinder Foundry to NTD is a major error because Intel 18A has advantages over N2