Semiconductor equipment welcomes Lidocolin/Yingcai. ASML ADR exceeds 1,000

Lam Research Corp., a manufacturer of semiconductor etching machines, received double-popular benefits, and its share price rose to a record high, while other US semiconductor equipment stocks also rose sharply.

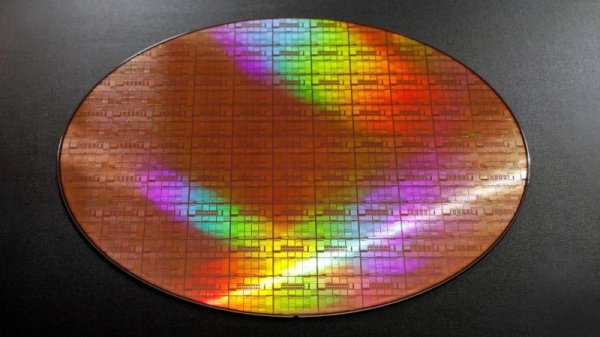

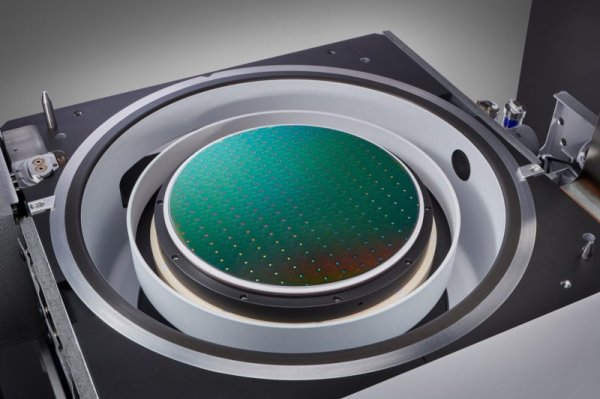

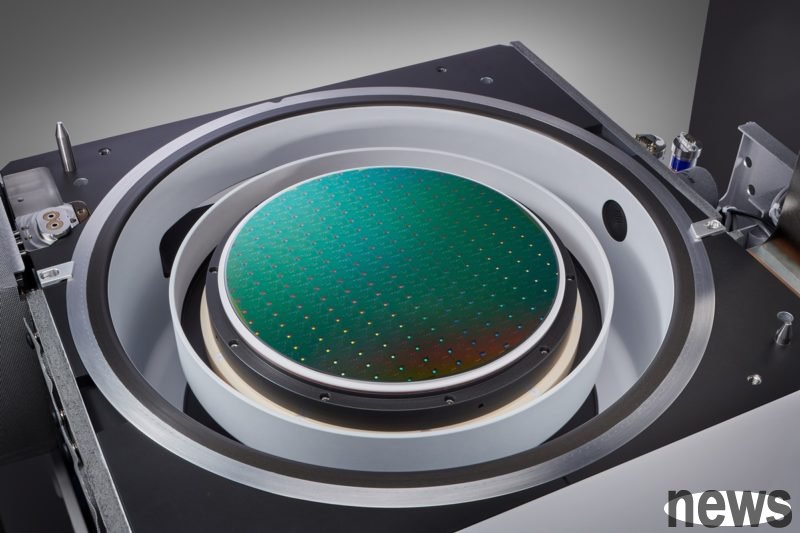

According to reports from The Motley Fool, ChatGPT's parent company OpenAI announced on the 1st that it had signed a contract with Korean memory giants Samsung Electronics and SK Hynix to provide the requirements for the "Stargate" project. Due to the popularity of Korean citizens for ChatGPT, the three companies also agreed to build several "Stargate Korea" data centers.Based on the information disclosed, the above agreement may eventually lead to the monthly supply of Stargate-based silicon wafers to 900,000 pieces, equivalent to 40% of the total capacity of DRAM industry today.

This is likely to prompt investment and expansion of DRAM and NAND flash memory manufacturers, which means purchasing more semiconductor equipment developed by Colin.

In addition to the good news from the memory, Intel Corp. reported that it is initially negotiating Crystalline Foundry with Supermicro (AMD), which also boosted the stock price trend of Colin R&D.

As of now, Intel has closed the conversation about whether the 18A process or next-generation 14A process has been obtained. Even in the latest financial report, it mentioned that if a large external customer cannot be found, "it may be suspended or even terminated the development of the Intel 14A and subsequent process, as well as related development plans."

Motley Fool pointed out that if AMD or other chip manufacturers want to become customers of Intel's foundry department, Intel is more likely to invest in 14A chip factories and then purchase equipment developed by Colin.

Colin's R&D ended on the 1st with a surge of 6.64%, closing at $142.79, setting a record high in history; it has risen by 97.69% so far this year. The materials were simultaneously elevated by 6.35% and closed at US$217.74, reaching a new closing high since July 23, 2024; it has risen by 33.89% so far this year.

On the other hand, KLA Corporation, a manufacturer of crystal testing equipment, jumped 4.66% on the 1st and closed at $1,128.87, setting a record high in history; it has risen by 79.15% so far this year. The Dutch semiconductor equipment industry ASML Holding N.V. ADR rose 3.63% and closed at US$1,003.27, the first time since July 16, 2024 to reach an overall balance of US$1,000; it has risen by 44.76% so far this year.

NVIDIA (Nvidia Corp.) recently announced that it would invest $5 billion in Intel and jointly carry out chip design. Timothy Arcuri, an analyst at UBS, previously pointed out that this agreement is beneficial to semiconductor equipment stocks, especially Cole, as it will increase the survival rate of Intel's round-the-foundry industry and improve Intel's long-term capital expenditure outlook.

Extended reading: Colin's 14-day trip to SKY, E-Materials Focus on Micron's capital expenditure With 900,000 pieces of crystal memory demand per month, Samsung and SK Hynix entered the OpenAI Star Gate Ecology System Turn from competition to cooperation? Intel's contact with AMD promotes its own crystal circle foundry services to boost stock prices